Understand the moving average

A moving average is a technical indicator that smooths the prices by creating an updated average price (each candle). In simple terms, at each candle, we take the N previous candles and we calculate the average. So, we have one point by candle and once you aggregate them, you obtain a moving average.

An important thing to mention is that, you can calculate the average using different methods: simple average, exponential average, smoothed average…

Usually, we combine two MAs (Moving averages) computed on different periods (the number of candles we look backward to compute the average) to have some information about the price trend. The moving average computed using the lowest period is called the fast MA and the one computed using the highest period is called the slow moving average.

When the fast moving average is above the slow moving average, we assume that we are into a bullish trend and if the fast moving average is below the slow moving average, we assume being into a bearish trend.

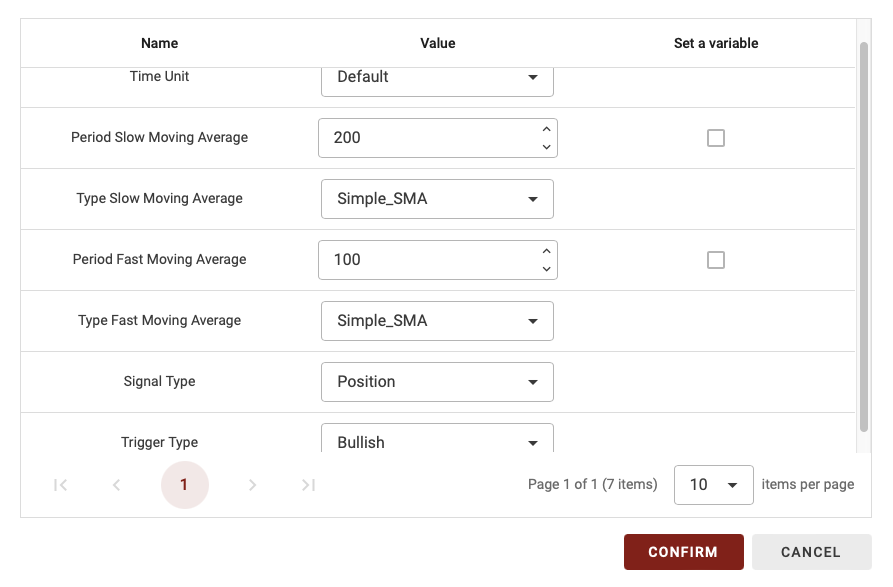

The M.A Crossovers block configuration

On BullTrading, you have a lot of possibilities to configure each block to make it unique. In this block, you will be able to define the Time Unit, the type of moving average, the period and much more…

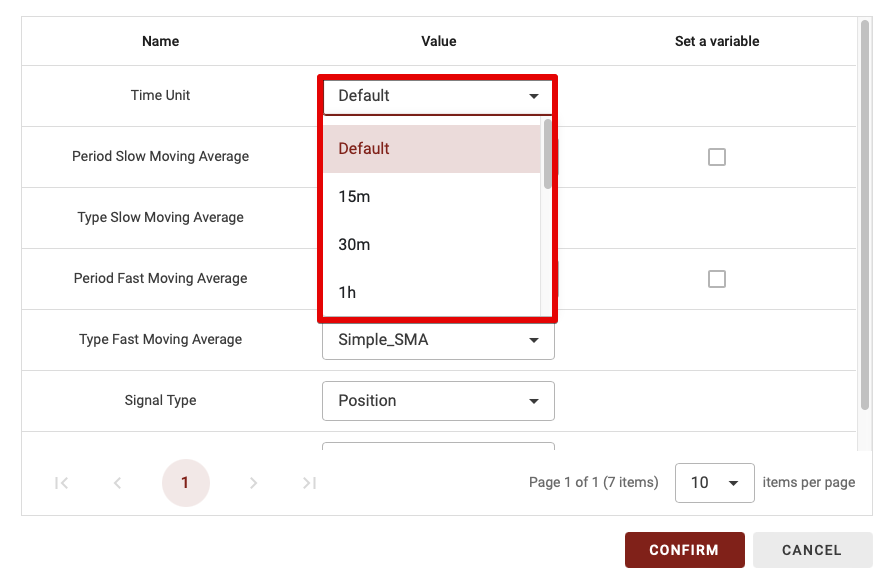

Time Unit

As Bulltrading has the possibility to create a multi time-frames strategy, you have the possibility to chose on which timeframe you will compute this indicator. So, you have two possibilities:

- Default: if you let default, the time unit will vary depending on the timeframe you are using into the backtest.

- 15m,30m,1d…: If you choose a specific timeframe into the time unit, it means that you will chose this specific timeframe no matter the timeframe you use to backtest your strategy.

TIPS: If you are beginner I advise you to let the time unit as default.

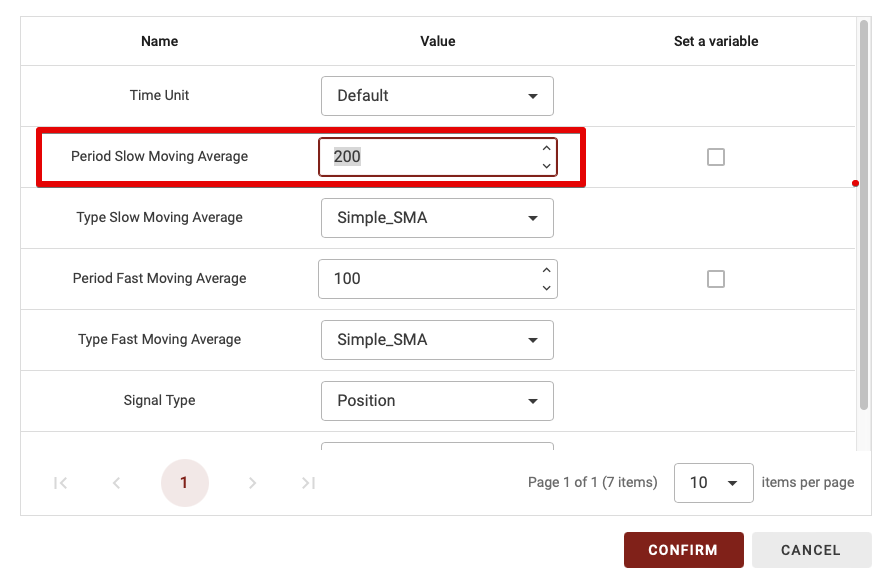

Period Slow Moving Average

The second parameter is the slow moving average period. To choose it, you just have to replace on the value and enter the number of period you want to use.

TIPS: You can only put integer number (without decimal)

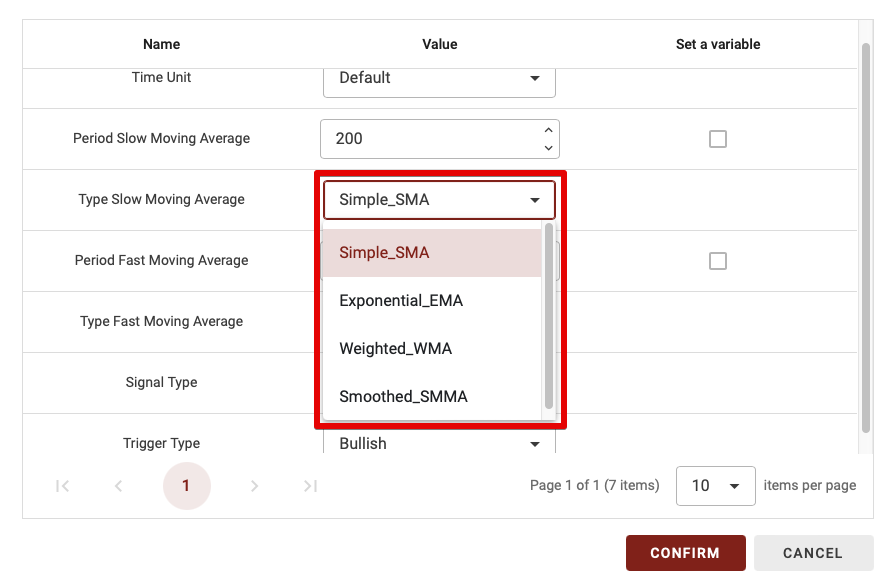

Type Slow Moving Average

As I explained it in the first section, there are several type of Moving Averages: simple moving average (SMA), exponential moving average (EMA), weighted moving average (WMA), smoothed moving average (SMMA), … This parameter gives you the possibility to choose the type of moving average you use for the slow moving average.

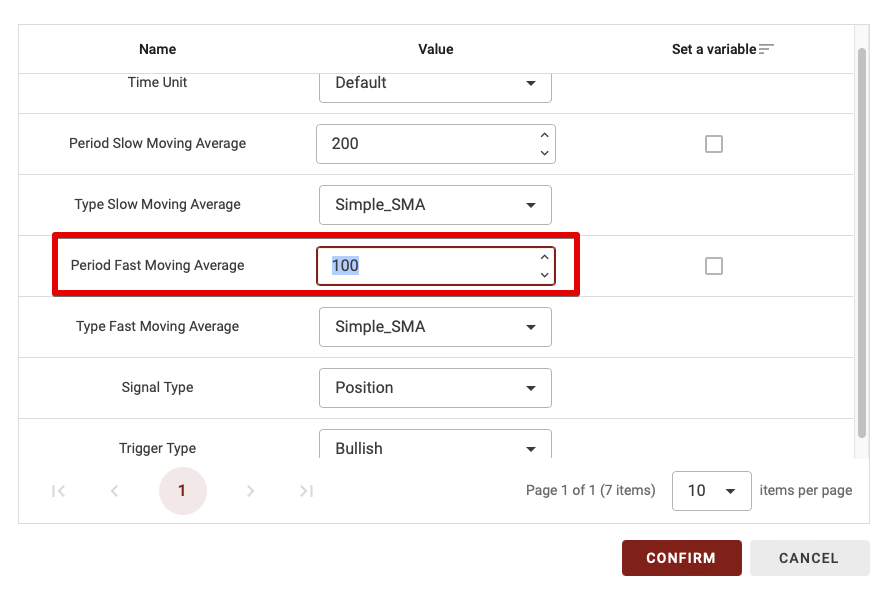

Period Fast Moving Average

This parameter is the period of the fast moving average. Like for the second parameter to choose it, you just have to replace on the value and enter the number of period you want to use to compute the fast moving average.

TIPS: You can only put integer number (without decimal)

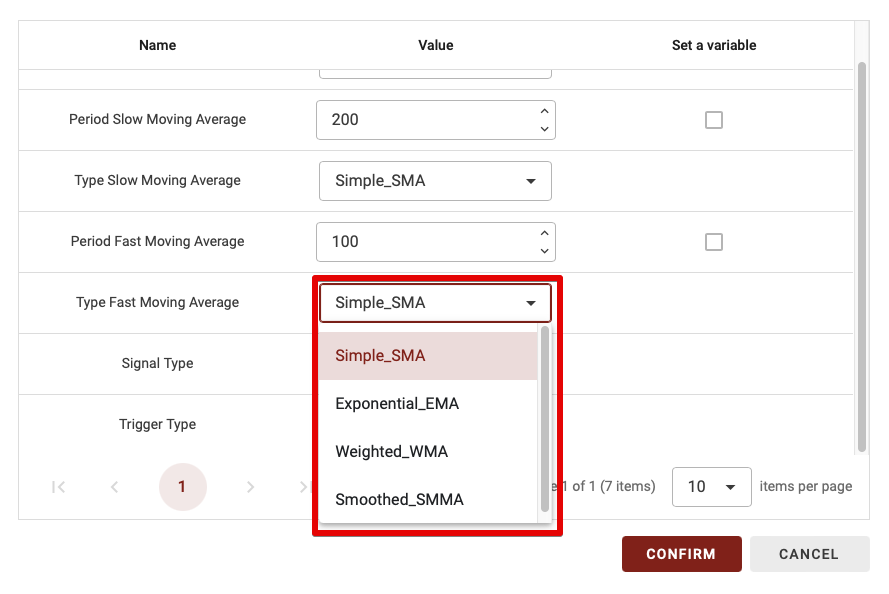

Type Fast Moving Average

The BullTrading block has a very high level of customizability. So, you have the possibility to choose a different type of moving average for the fast moving average than for the slow moving average. You have the same possibilities.

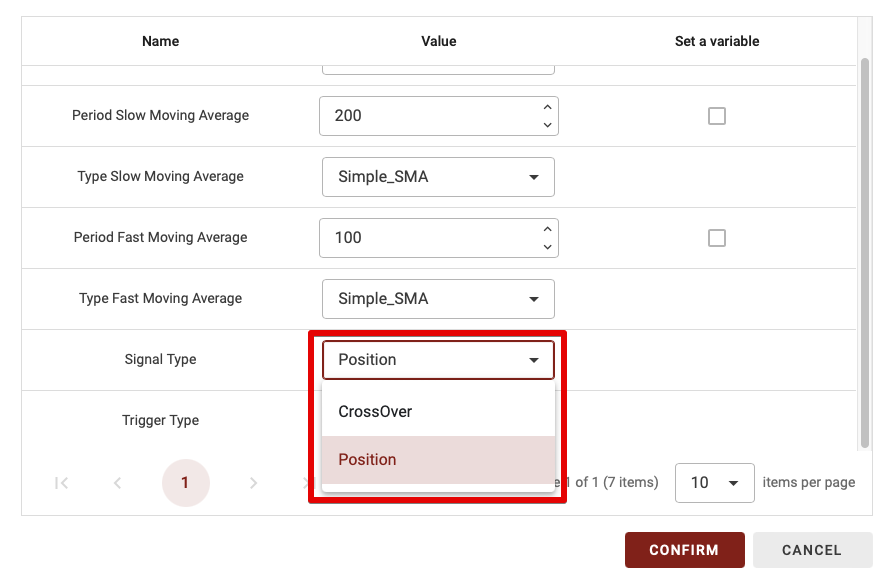

Signal Type

This parameter has only two possibilities: CrossOver and Position. Let’s explain the difference this parameter will bring:

- CrossOver: if you choose CrossOver for the Signal Type, this block will be validated only when we have a crossing between the two moving averages.

- Position: with this possibility, the block will be validated any time when the fast moving average is above or below (depending on the next parameter) the slow moving average.

TIPS: the CrossOver parameter is much more restrictive, so it is interesting to use it when you have only one or two indicators combined. However, if you have too much blocks combined with the Crossover parameter, it will reduce a lot the number of trades in your strategy because we need for example a crossing between the two MAs + a crossing between the 70 threshold of the RSI + a crossing in the Vortex indicator…

So, when you combine several indicator blocks, do not put more than 1 or 2 block with the CrossOvers parameter if you are beginner.

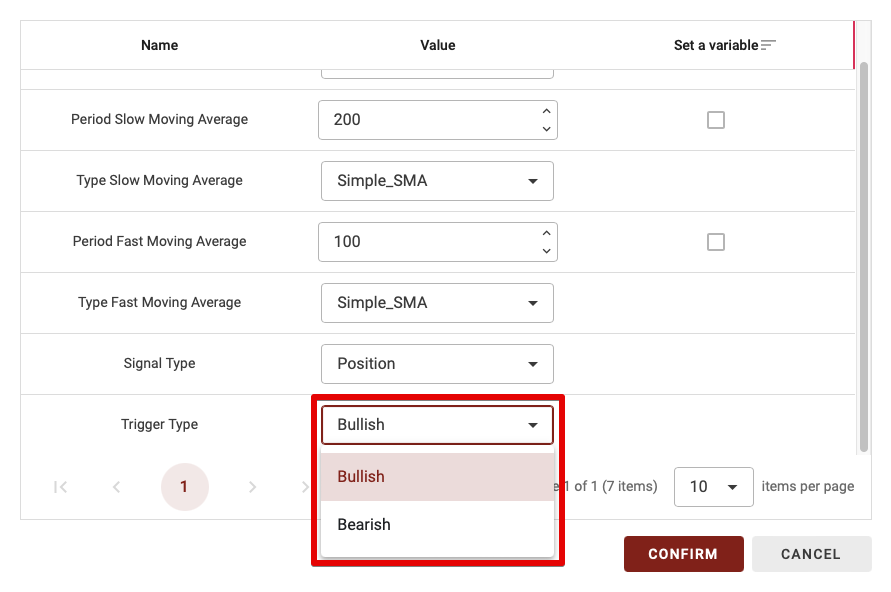

Trigger Type

This parameter has only two possibilities: Bullish or Bearish. Let’s explain the difference:

- Bullish: if you set the Trigger type as Bullish, the block is validated if the fast MA is above or cross up the slow MA (depending on the Signal Type).

- Bearish: if you set the Trigger type as Bearish, the block is validated if the fast MA is below or cross down the slow MA (depending on the Signal Type).