Understanding the SuperTrend

The SuperTrend indicator is a technical indicator used to identify the dominant trend in a financial asset. One of the positive points of this indicator is that it takes into account market volatility via the ATR (Average True Range).

Simplicity is one of the major advantages of SuperTrend. All that’s required is the period used to calculate the indicator and the number of times the ATR is multiplied in the SuperTrend calculation.

As simplicity is not without consequence, it is often combined with other indicators to refine signal quality.

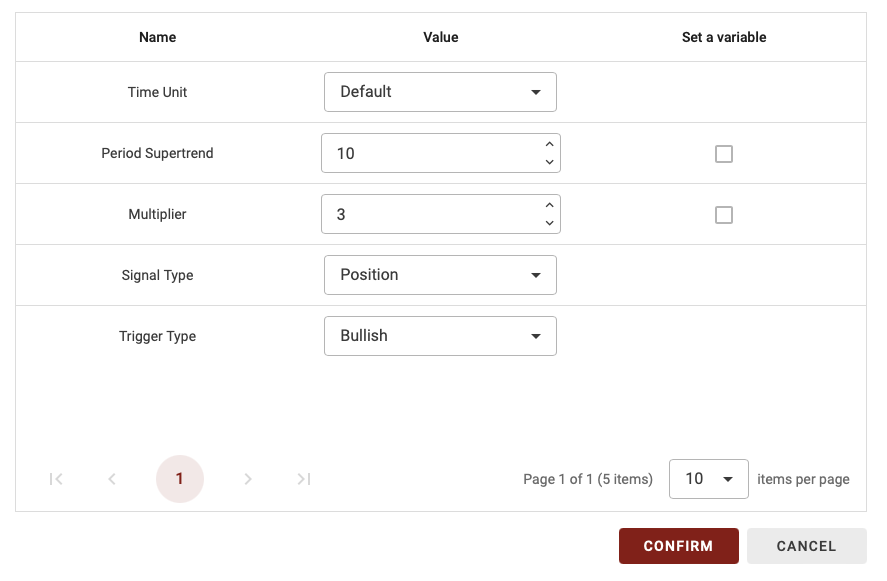

SuperTrend block configuration

On BullTrading, you can configure each block to make it unique. In this block, you can define the time unit, the period used, …

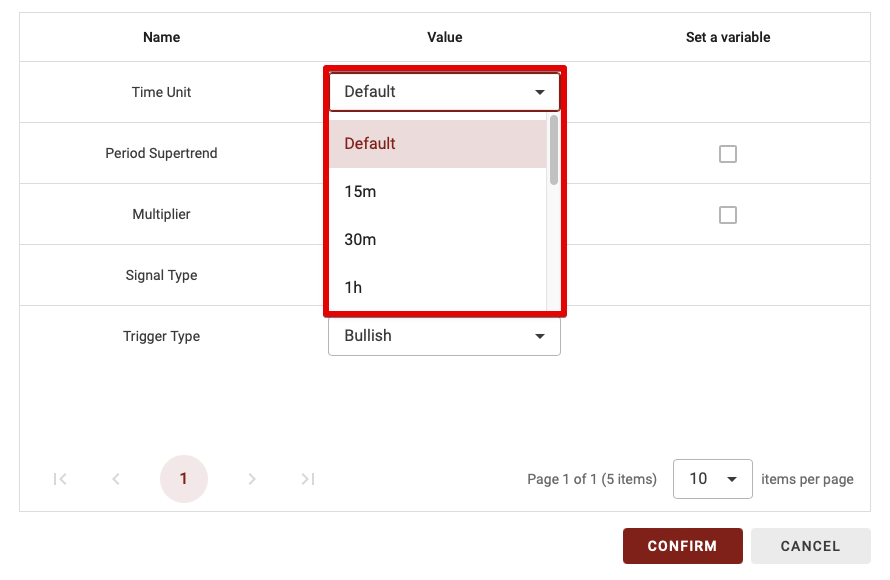

Time Unit

As Bulltrading has the ability to create a multi-timeframe strategy, you have the option of choosing which time period to calculate this indicator on. There are two possibilities:

- Default: if you leave Default, the time unit will vary according to the time horizon you use in the backtest.

- 15m,30m,1d… : If you choose a specific time unit in the time unit, this means that you will choose this specific time unit whatever time unit you use to backtest your strategy.

TIP: If you’re a beginner, I advise you to leave the default time unit.

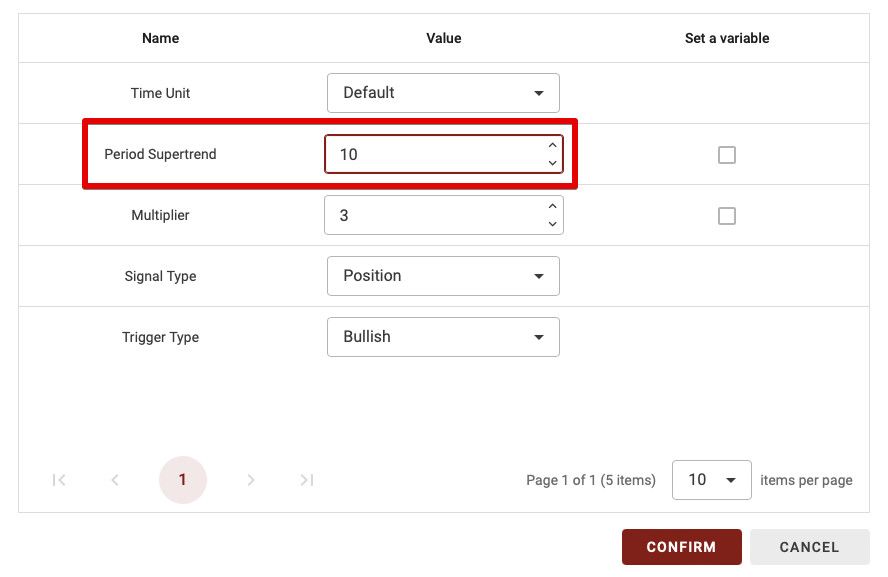

Period SuperTrend

The second parameter is the SuperTrend period. To select it, simply replace the value and enter the number of periods you wish to use.

CONSEILS : Vous ne pouvez mettre que des nombres entiers (sans décimale).

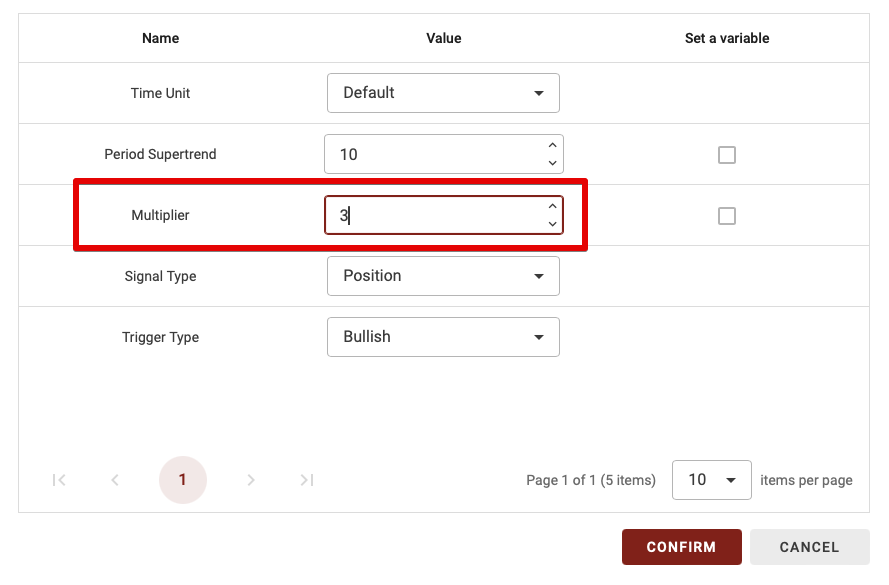

Multiplier

The multiplier influences the sensitivity of the indicator: the lower the multiplier, the more sensitive the indicator. The default value is around 2 or 3, depending on the strategy. If the value exceeds 3, the indicator becomes less sensitive to variations (which can be interesting depending on the desired strategy).

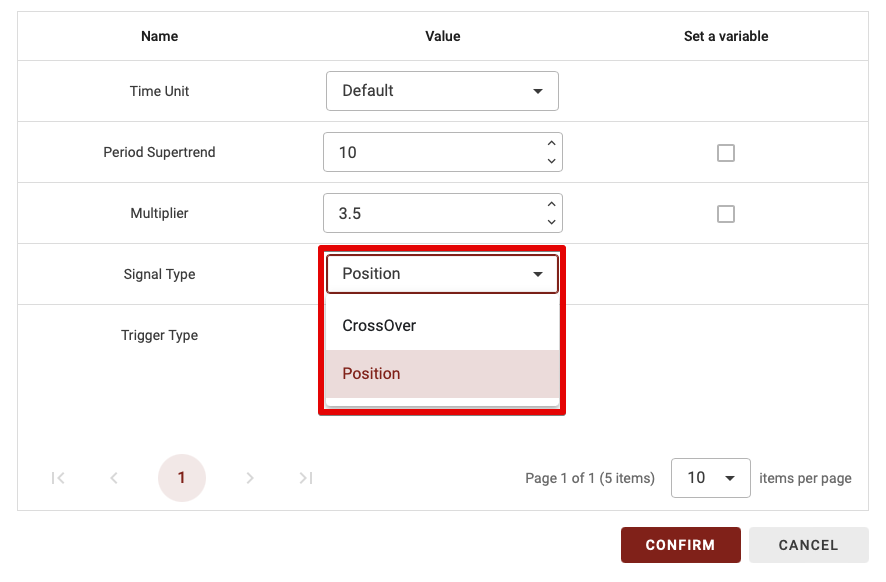

Signal Type

This parameter has only two possibilities: CrossOver and Position. Let’s explain the difference this parameter makes:

- CrossOver: if you choose CrossOver for Signal Type, this block will be enabled only when the signal changes from Bearish to Bullish or vice versa.

- Position: with this option, the block will be validated whenever you are in the chosen trigger type (Bearish or Bullish).

TIPS: the CrossOver parameter is much more restrictive, so it’s worth using it when you only have one or two indicators combined. However, if you have too many blocks combined with the Crossover parameter, this will greatly reduce the number of trades in your strategy, as we need, for example, a crossover between the two MAs + a crossover between the RSI 70 threshold + a crossover in the Vortex indicator…

So, when combining several indicator blocks, don’t set more than 1 or 2 blocks with the CrossOvers parameter if you’re a beginner.

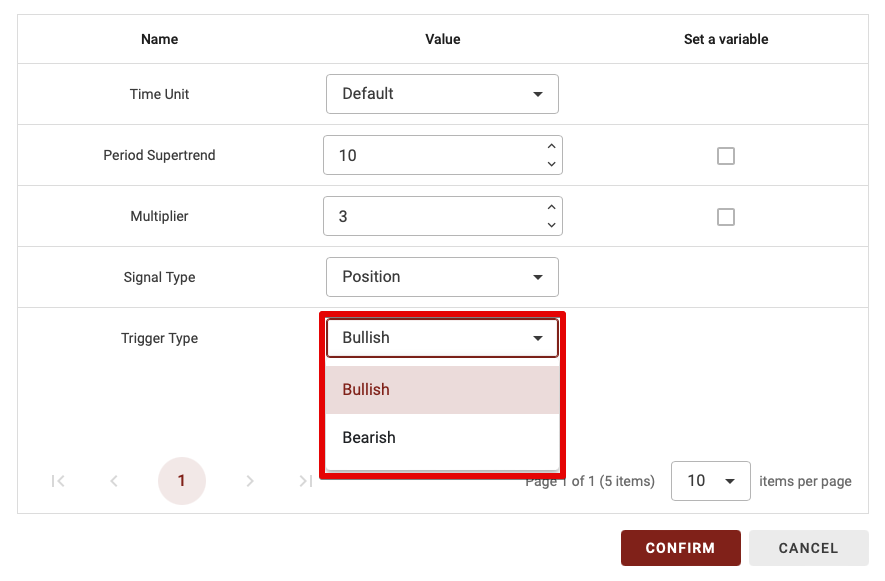

Trigger Type

This parameter has only two possibilities: Bullish or Bearish. Let’s explain the difference:

- Bullish: if you set the trigger type to bullish, the block is validated if the SuperTrend is in a bullish position.

- Bearish: if you set the trigger type to Bearish, the block is validated if the SuperTrend is in a bearish position.