Understanding the RSI

The RSI (Relative Strength Index) is a technical indicator that evaluates the strength of a trend in the price of a financial asset. The aim is to identify overbought or oversold conditions in a market. Without going into the details of the calculation, the indicator will use the average gains and losses over the last N candles to understand which force is more important: bullish or bearish.

The value of the RSI lies between 0 and 100. If the RSI is above 70, we speak of an overbought condition. On the other hand, if the RSI is below 30, we speak of an oversold condition.

It’s also important to note that RSI is often combined with other indicators to obtain more precise market entry and exit signals.

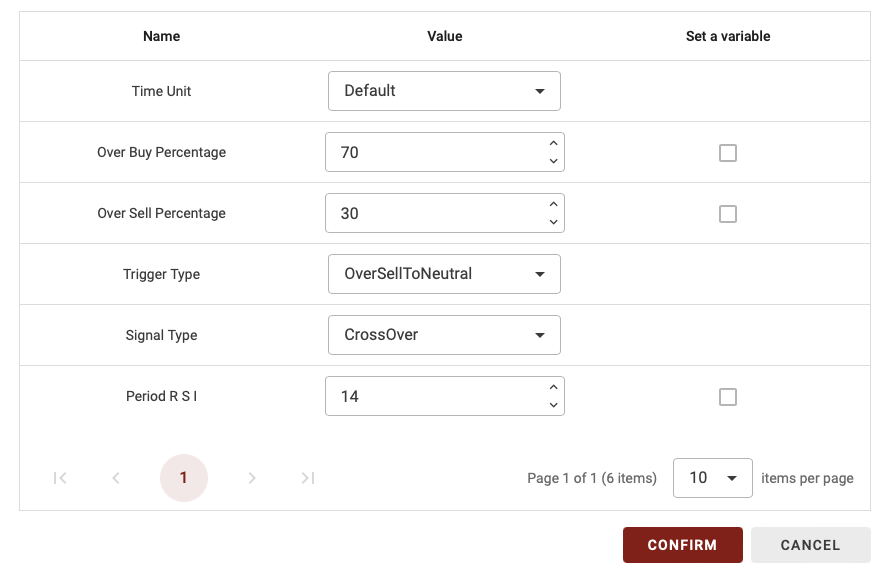

RSI block configuration

On BullTrading, you can configure each block to make it unique. In this block, you can define the time unit, overbought and oversold thresholds, etc.

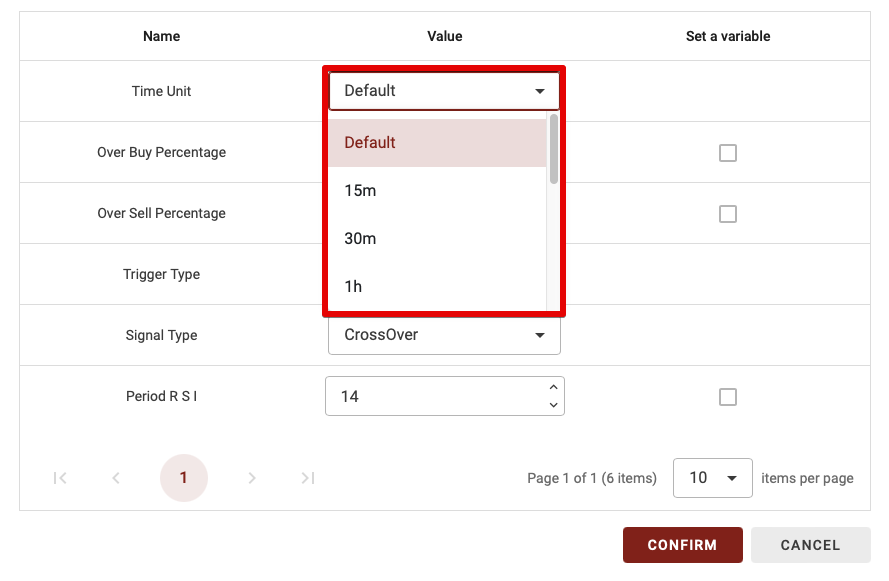

Time Unit

As Bulltrading is able to create a multi-frame strategy, you have the option of choosing the time period over which to calculate this indicator. You therefore have two options:

- Default: if you leave Default, the time unit will vary according to the time horizon you use in the backtest.

- 15m,30m,1d… : If you choose a specific time unit in the time unit, this means that you will choose this specific time unit whatever time unit you use to backtest your strategy.

TIP: If you’re a beginner, I advise you to leave the default time unit.

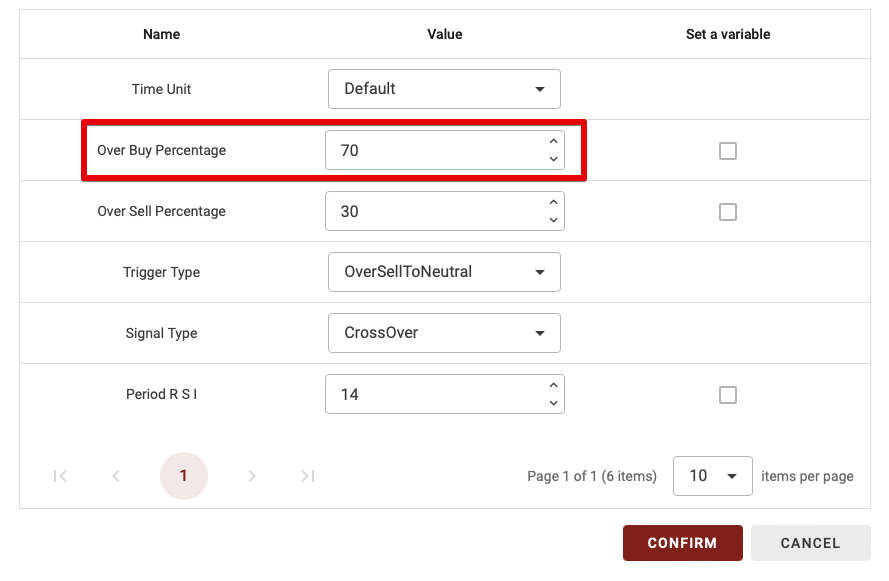

OverBuy Percentage

The second parameter is the overbought threshold. It defines the level of force at which we consider ourselves to be in an overbought situation.

TIPS: You can only enter whole numbers (without decimals).

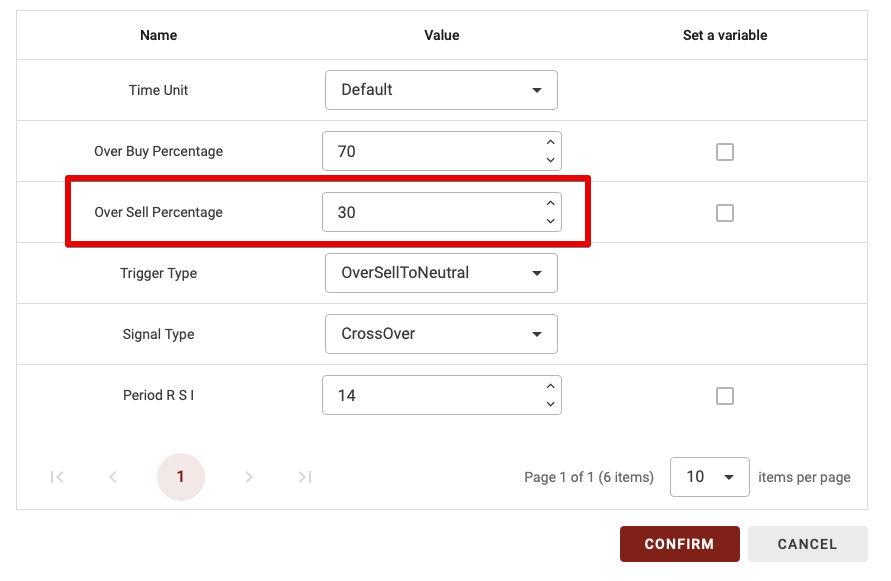

OverSell Percentage

The second parameter is the oversold threshold. It defines the level of force below which we consider ourselves to be in an oversold situation.

TIPS: You can only enter whole numbers (without decimals).

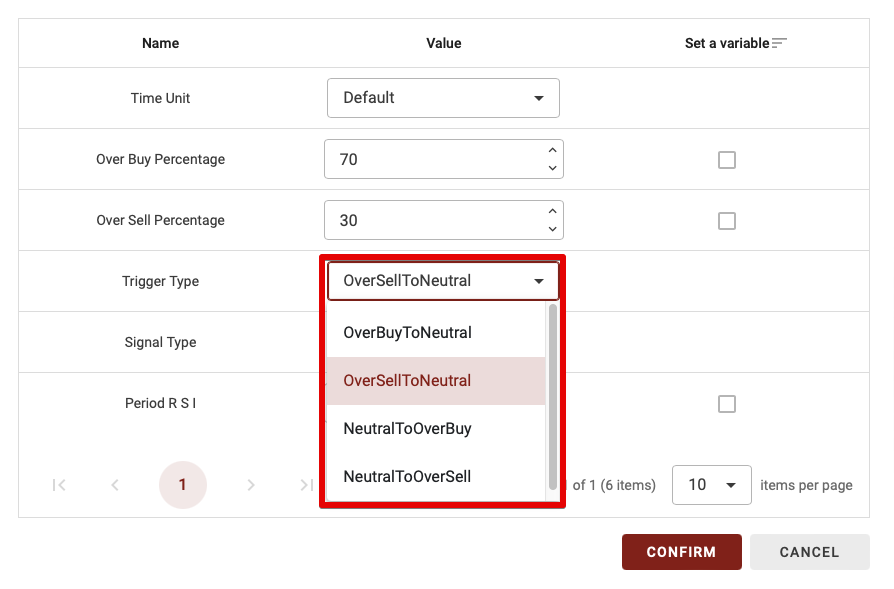

Trigger Type

This parameter has several possibilities: OverBuyToNeutral, OverSellToNeutral, NeutralToOverBuy, NeutralToOverSell. Let’s explain the difference:

- OverBuyToNeutral: if you use this trigger, have a signal when you were in OverBuy (in the zone above the Over Buy Percentage) and you are in Neutral (which is the zone between the oversold and overbought zones).

- OverSellToNeutral: similar to the previous point, except that you were in the oversold zone and are now in the neutral zone.

- NeutralToOverBuy: this is the most frequently used trigger, and is used to trigger the block when moving from the neutral zone to the overbought zone.

- NeutralToOverSell: with this trigger, to activate the block when you are or when you move (depending on the next point) from the neutral zone to the oversold zone.

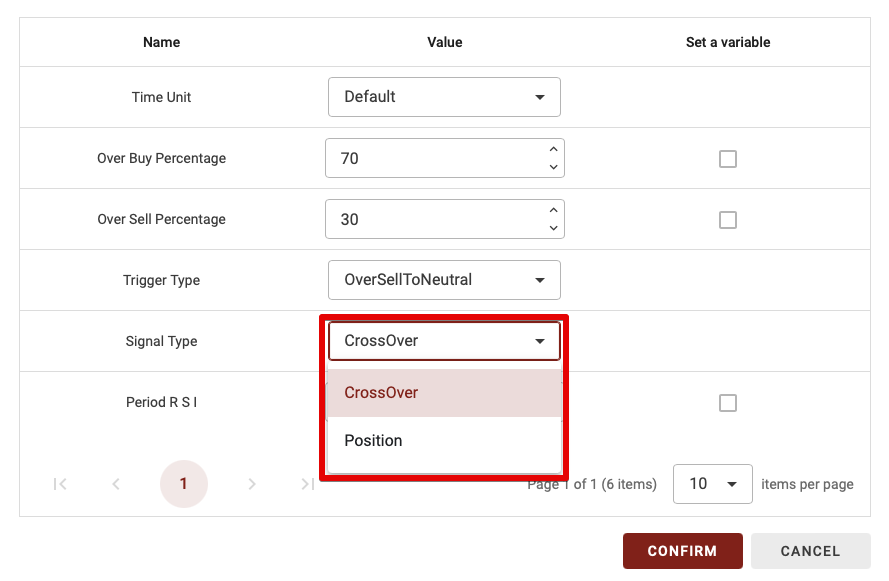

Signal Type

This parameter has only two possibilities: CrossOver and Position. Let’s explain the difference this parameter makes:

- CrossOver: if you choose CrossOver for the signal type, this block will be validated only when we have a transition from one zone to another after crossing the overbought or oversold threshold.

- Position: with this option, the block will be validated each time you find yourself in the chosen zone. For example, if you’re in the neutral zone and have just come from the overbought zone, then no matter what the RSI value, the block will be validated (because we know it’s in the desired zone).

TIPS: the CrossOver parameter is much more restrictive, so it’s worth using it when you only have one or two indicators combined. However, if you have too many blocks combined with the Crossover parameter, this will greatly reduce the number of trades in your strategy, as we need, for example, a crossover between the two MAs + a crossover between the RSI 70 threshold + a crossover in the Vortex indicator…

So, when combining several indicator blocks, don’t set more than 1 or 2 blocks with the CrossOvers parameter if you’re a beginner.

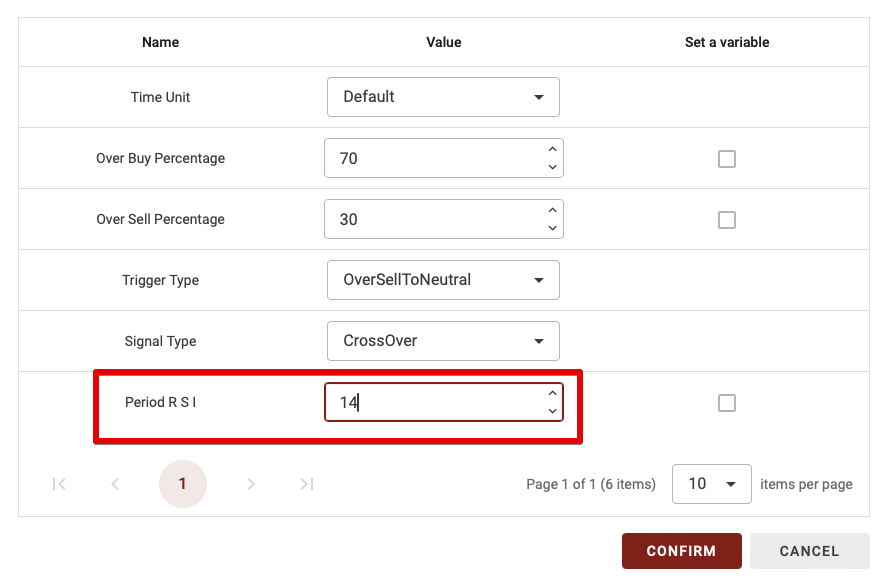

Period RSI

TIPS: You can only enter whole numbers (without decimals).