Understanding Bollinger Bands

The Bollinger Bands indicator is a well-known technical analysis classic. This indicator is used to understand whether the price is deviating abnormally from the average price (either on the bearish or bullish side).

To do this, we frame the price of a financial asset between 2 (Bollinger) bands, which take into account the asset’s volatility. Interpretation is fairly straightforward. If you break out of the band at the top, you’re overbought; if you break out at the bottom, you’re oversold.

Depending on the asset’s tendency to revert to the mean, two strategies may then emerge, or depending on the timeframe used. If we assume that the asset in question is stationary, we’ll take a short position if we find ourselves above the zone. On the other hand, if we think that the asset is in a stronger momentum, as was the case during the Bullrun, we’ll take a long position if we find ourselves above the zone, as we hope that this momentum will continue. We do the opposite for the lower zone.

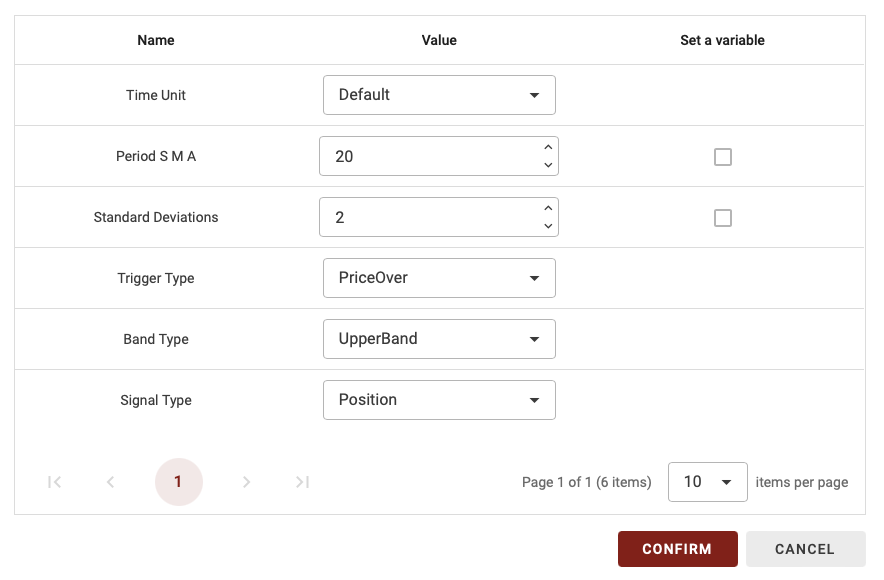

Bollinger Bands block configuration

On BullTrading, you can configure each block to make it unique. In this block, you can define the time unit, the period used, …

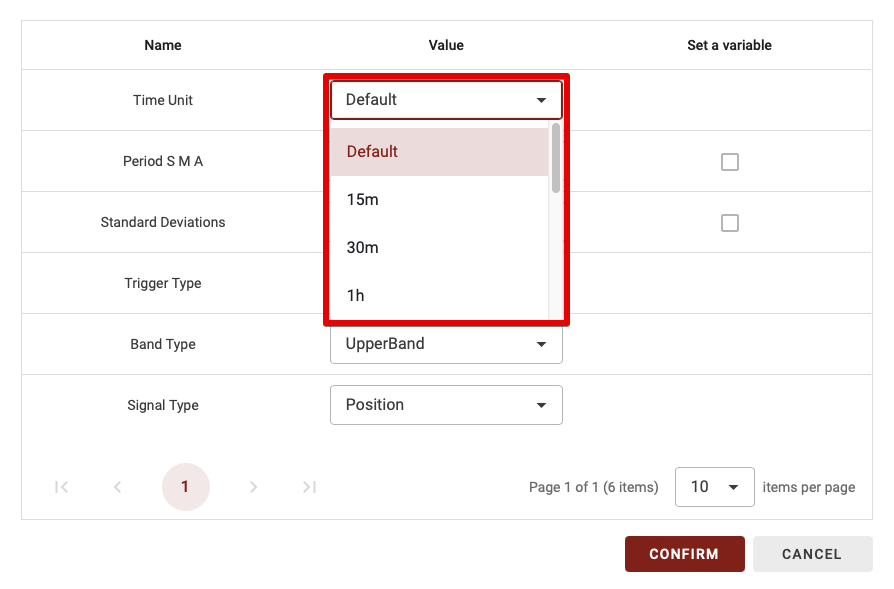

Time Unit

As Bulltrading has the ability to create a multi-timeframe strategy, you have the option of choosing which time period to calculate this indicator on. There are two possibilities:

- Default: if you leave Default, the time unit will vary according to the time horizon you use in the backtest.

- 15m,30m,1d… : If you choose a specific time unit in the time unit, this means that you will choose this specific time unit whatever time unit you use to backtest your strategy.

TIP: If you’re a beginner, I advise you to leave the default time unit.

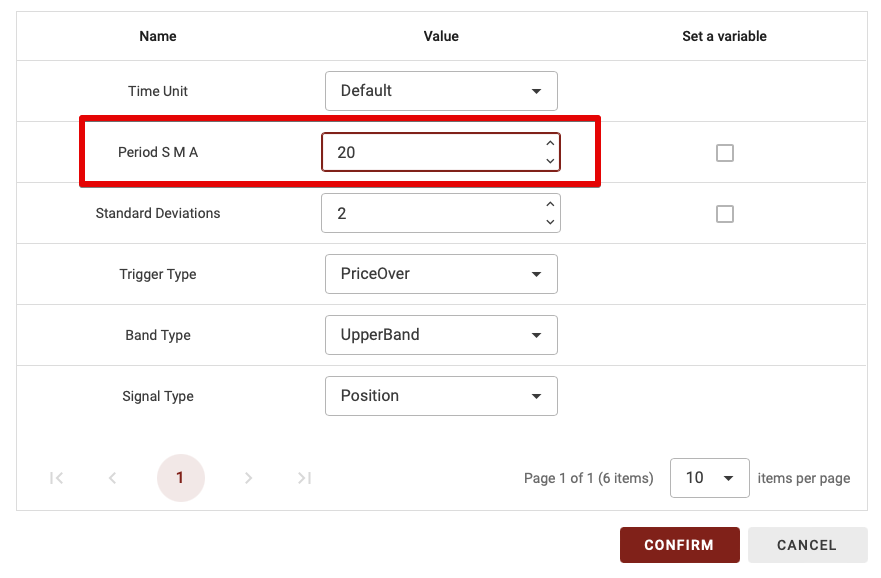

Period SMA (période de la SMA)

To create Bollinger bands, you need to create a moving average, so this is where you choose the period to use. We implicitly choose the same period for calculating moving volatility, to avoid any problems.

TIPS: You can only enter whole numbers (without decimals).

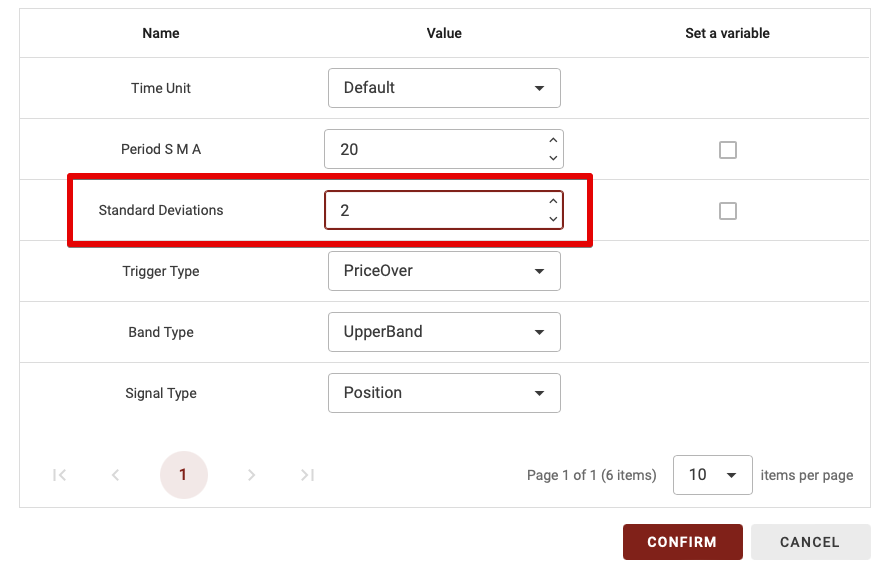

Standard Deviations

As explained above, the Bollinger bands form an area that frames the price. To construct it, we subtract N times the moving volatility from the moving average to obtain the low band, and add N times the moving volatility for the high band.

The greater the standard deviation multiplier, the more difficult it will be to break out of this zone. The default value is often 2 or 3.

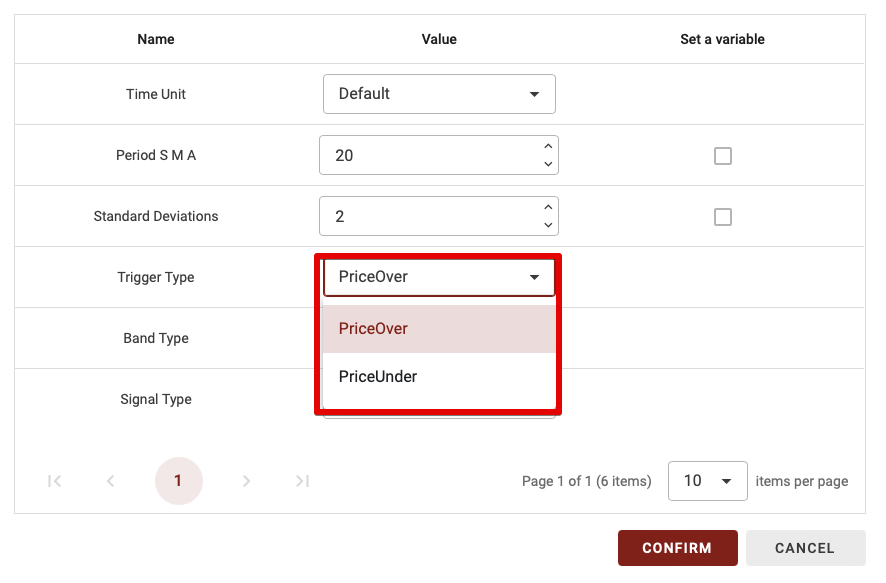

Trigger Type

As with the other indicators, we need to define when this indicator will be validated. For this indicator, it’s very simple: we have 2 possibilities:

- PriveOver: when the price is above or passes above the band we’ll choose in the next parameter.

- PriceUnder: when the price is below or passes below the band we’ll choose in the next parameter.

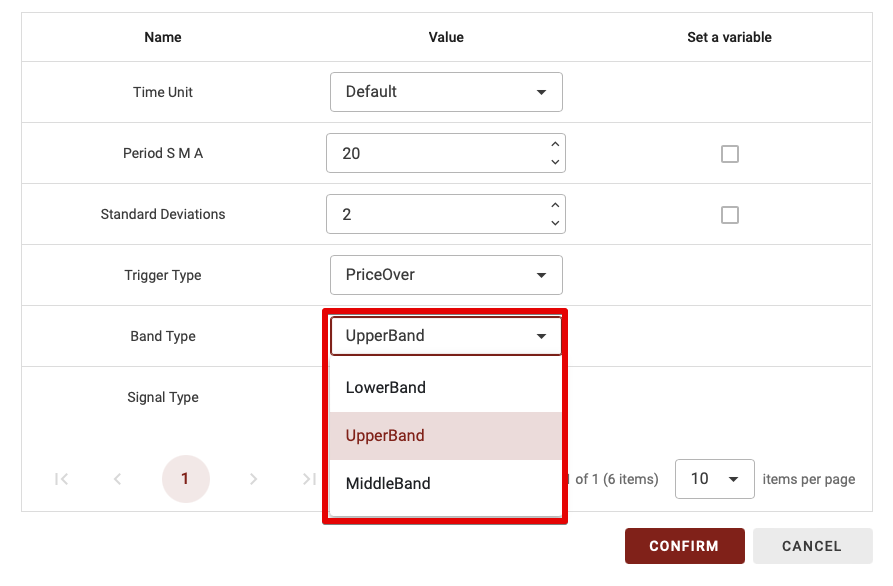

Band Type

We have 3 possible bands to define the condition created by this block: the middle band, which is simply the moving average. The lower band, which is the lower Bollinger band, and the upper band, which is the upper Bollinger band.

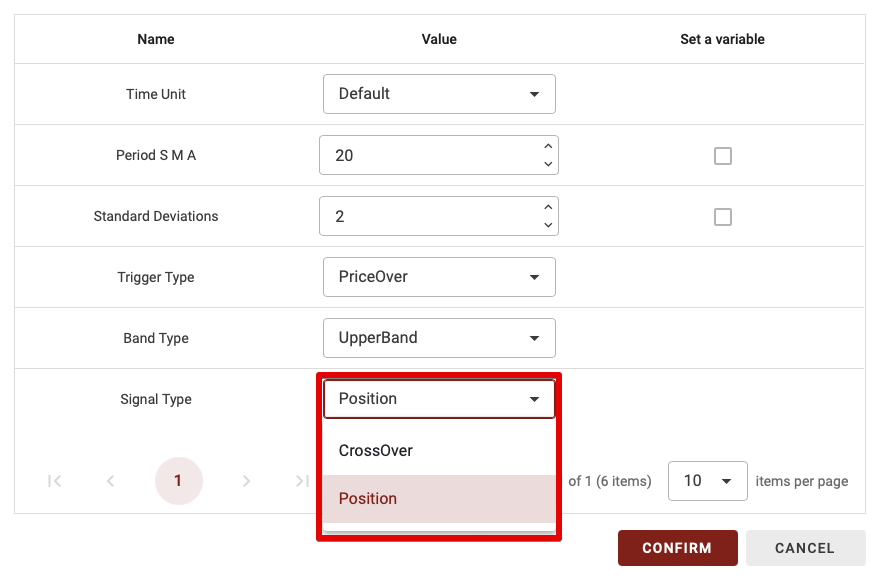

Signal Type

This parameter has only two possibilities: CrossOver and Position. Let’s explain the difference this parameter makes:

- CrossOver: if you choose CrossOver for the signal type, this block will be validated only when the price goes above or below the chosen band, and only when crossing.

- Position: with this option, the block will be validated when the price is above or below the chosen band.

TIPS: the CrossOver parameter is much more restrictive, so it’s worth using it when you only have one or two indicators combined. However, if you have too many blocks combined with the Crossover parameter, this will greatly reduce the number of trades in your strategy, as we need, for example, a crossover between the two MAs + a crossover between the RSI 70 threshold + a crossover in the Vortex indicator…

So, when combining several indicator blocks, don’t set more than 1 or 2 blocks with the CrossOvers parameter if you’re a beginner.