Understanding the RSI Sto crossover indicator

The stochastic RSI indicator is extremely similar to the RSI indicator. It will also indicate overbought and oversold zones. However, instead of focusing on one RSI value, it will relate it to the minimum and maximum RSI of a certain period.

The purpose of this indicator is to compare the evolution of 2 stochastic RSIs, essentially over different periods.

RSI Sto crossover block configuration

On BullTrading, you can configure each block to make it unique. In this block, you can define the time unit, the period used, …

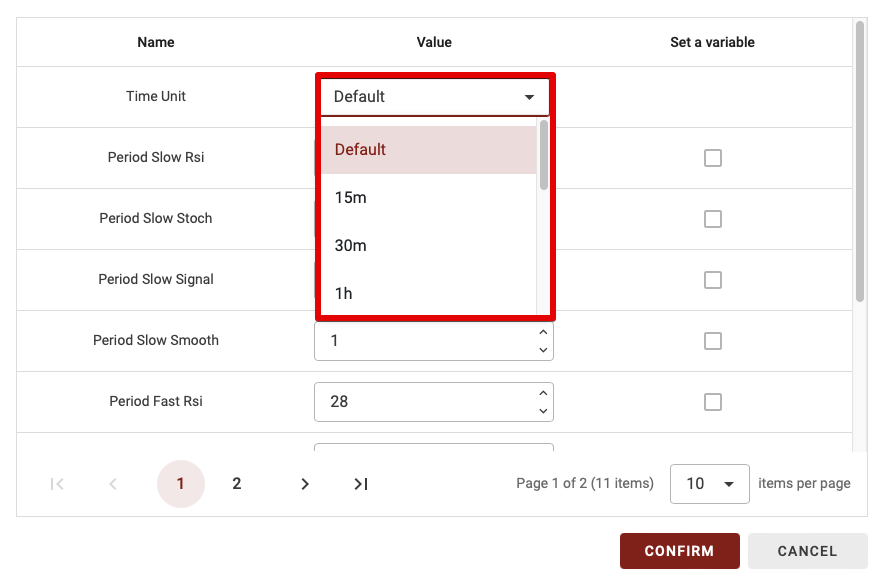

Time Unit (unité de temps utilisée)

As Bulltrading has the ability to create a multi-timeframe strategy, you have the option of choosing which time period to calculate this indicator on. There are two possibilities:

- Default: if you leave Default, the time unit will vary according to the time horizon you use in the backtest.

- 15m,30m,1d… : If you choose a specific time unit in the time unit, this means that you will choose this specific time unit whatever time unit you use to backtest your strategy.

TIP: If you’re a beginner, I advise you to leave the default time unit.

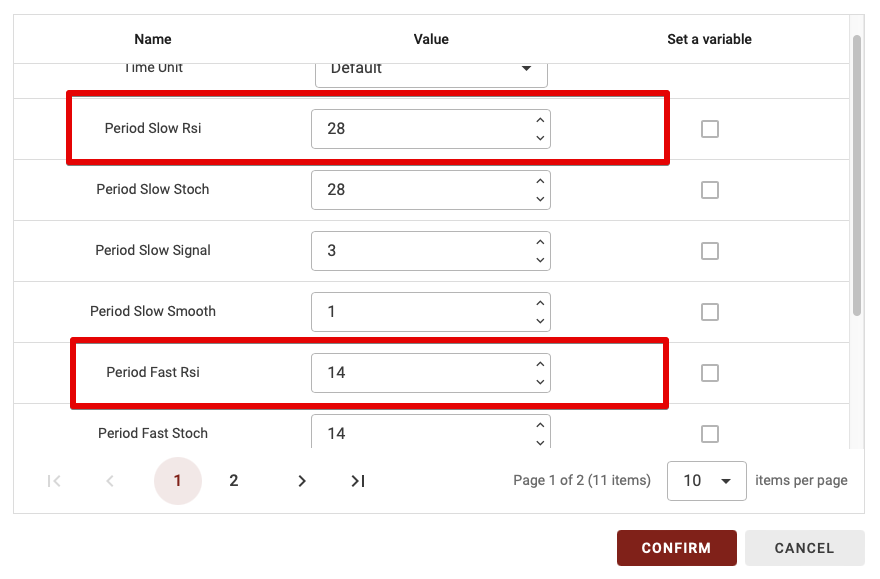

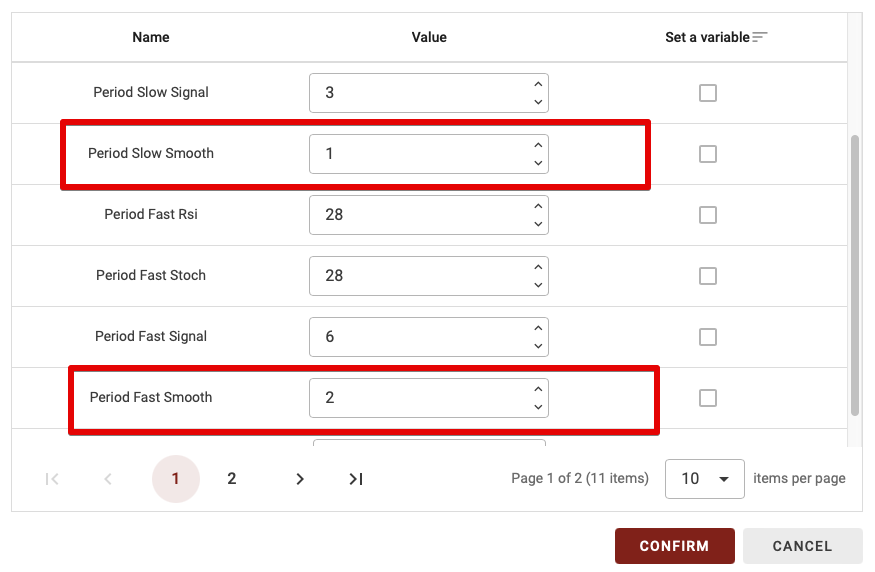

Slow & Fast Period RSI

As with most indicators, we need a period over which to calculate our RSI indicators. We therefore need two periods here: one for each RSI.

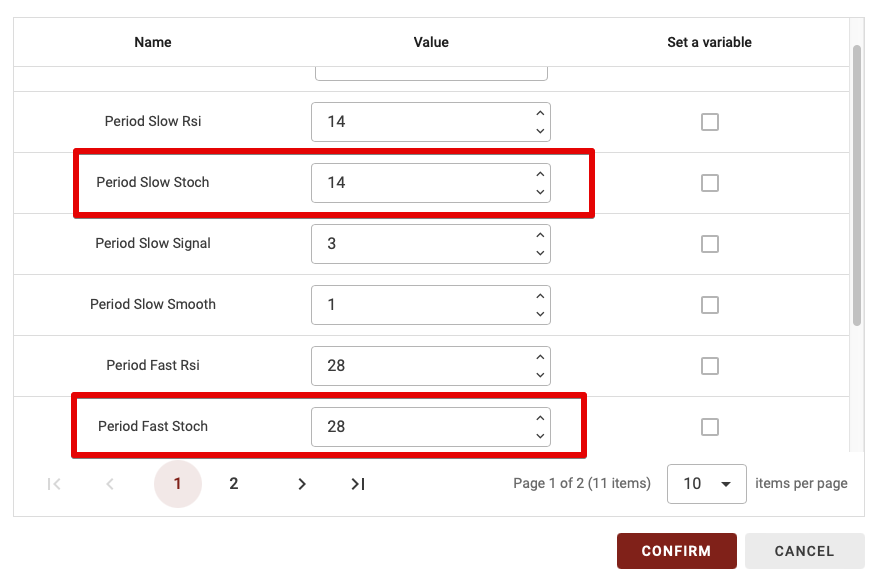

Slow & Fast Period Sto

Once the RSI has been calculated, we need to calculate the stochastic RSI, which also requires a period over which to calculate it. We also need 2: one for each stochastic RSI.

Slow & Fast Period Smooth

Once the stochastic RSIs have been calculated, they can be smoothed using moving averages. It is therefore necessary to choose the periods used for the various smoothing operations.

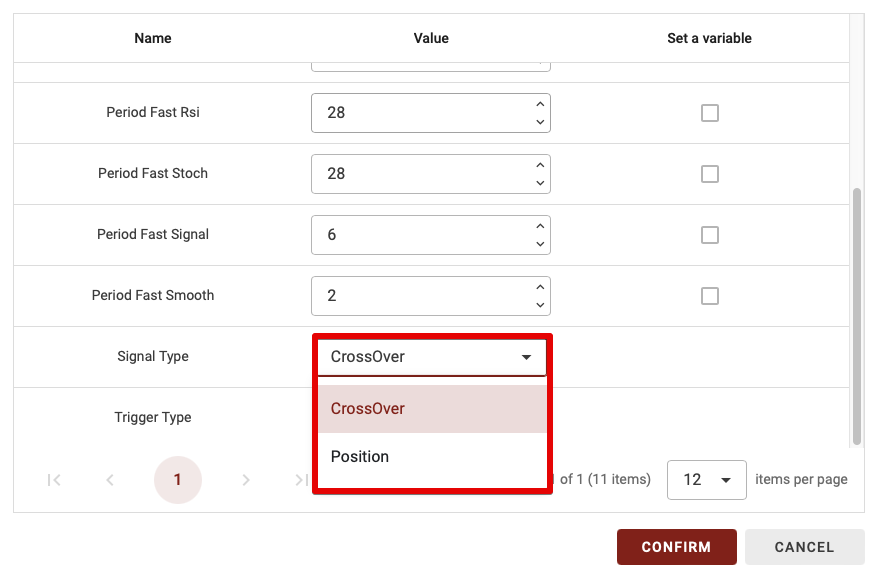

Signal Type

This parameter has only two possibilities: CrossOver and Position. Let’s explain the difference this parameter makes:

- CrossOver: if you choose CrossOver for the signal type, this block will be enabled only when the RSI Sto Fast line passes below or above the RSI Sto Slow line.

- Position: with this option, the block will be validated as long as you are in the chosen trigger type (Bearish or Bullish).

TIPS: the CrossOver parameter is much more restrictive, so it’s worth using it when you only have one or two indicators combined. However, if you have too many blocks combined with the Crossover parameter, this will greatly reduce the number of trades in your strategy, as we need, for example, a crossover between the two MAs + a crossover between the RSI 70 threshold + a crossover in the Vortex indicator…

So, when combining several indicator blocks, don’t set more than 1 or 2 blocks with the CrossOvers parameter if you’re a beginner.

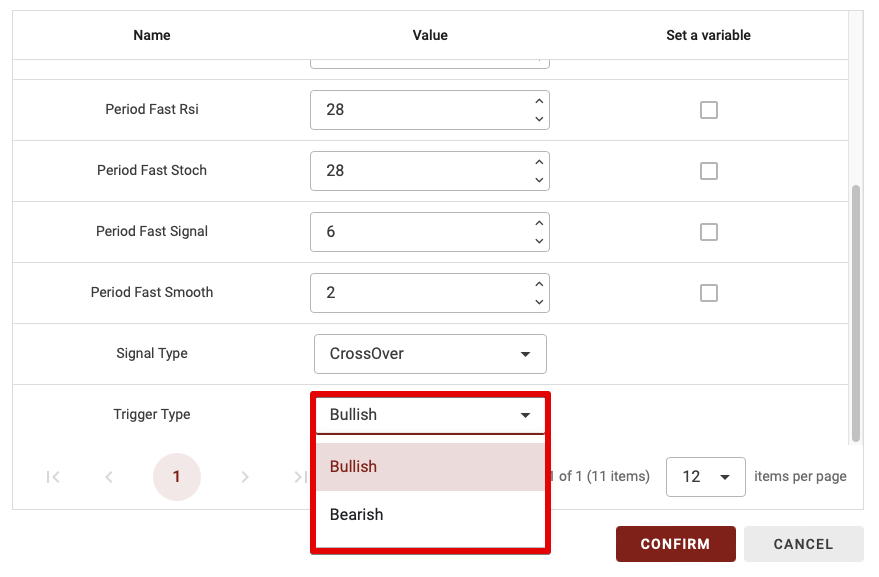

Trigger Type

This parameter has only two possibilities: Bullish or Bearish. Let’s explain the difference:

- Bullish: if you set the trigger type to bullish, the block is validated if the RSI Sto Fast line is above the RSI Sto Slow line.

- Bearish: if you define the trigger type as Bearish, the block is validated if the RSI Sto Fast line is below the RSI Sto Slow line.