Understanding the SAR indicator

The SAR (Stop and Reverse) indicator is a technical indicator used to identify trends and potential reversal points.

The indicator is made up of a series of points that lie either above or below the price. These points are calculated using the extreme price (highest or lowest during a trend) and an acceleration factor, which increases each time a new extreme price is reached.

If the SAR points are below the price, then the market is bullish. If they are above, then the market is bullish. The moment when a bearish SAR turns bullish and vice versa is called a reversal.

SAR block configuration

On BullTrading, you can configure each block to make it unique. In this block, you can define the time unit, the period used, …

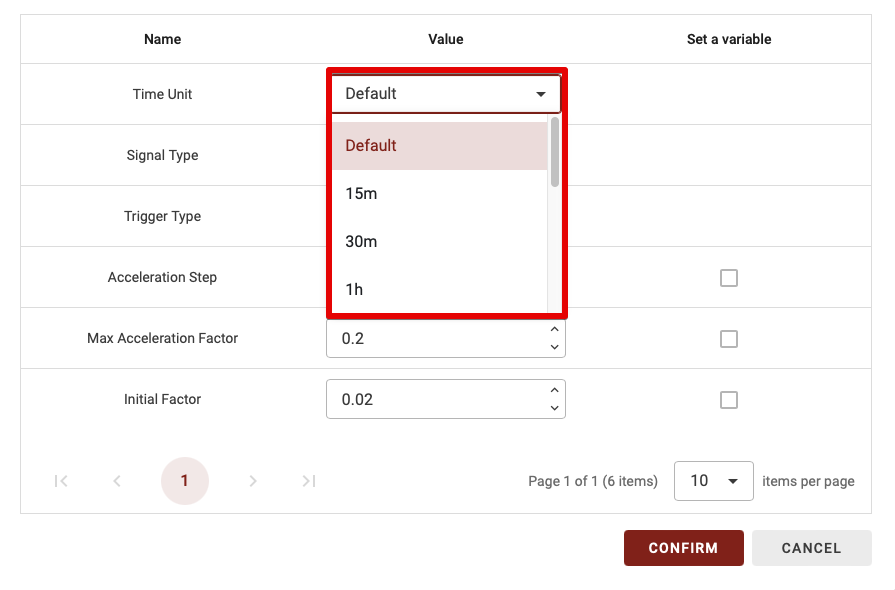

Time Unit

As Bulltrading has the ability to create a multi-timeframe strategy, you have the option of choosing which time period to calculate this indicator on. There are two possibilities:

- Default: if you leave Default, the time unit will vary according to the time horizon you use in the backtest.

- 15m,30m,1d… : If you choose a specific time unit in the time unit, this means that you will choose this specific time unit whatever time unit you use to backtest your strategy.

TIP: If you’re a beginner, I advise you to leave the default time unit.

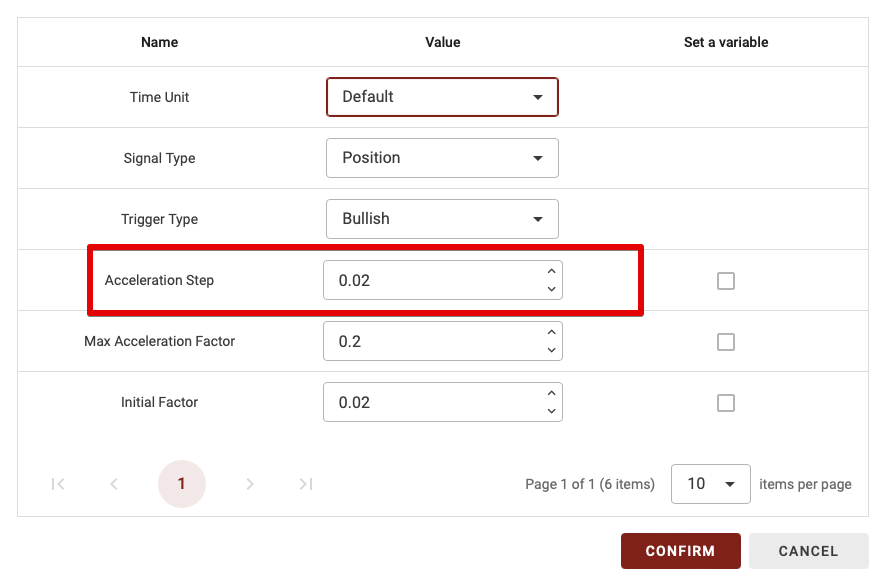

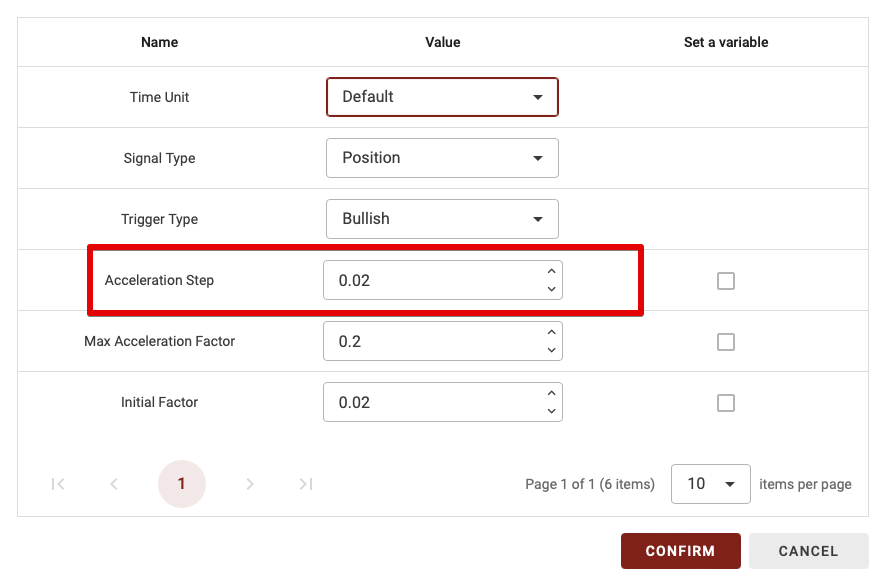

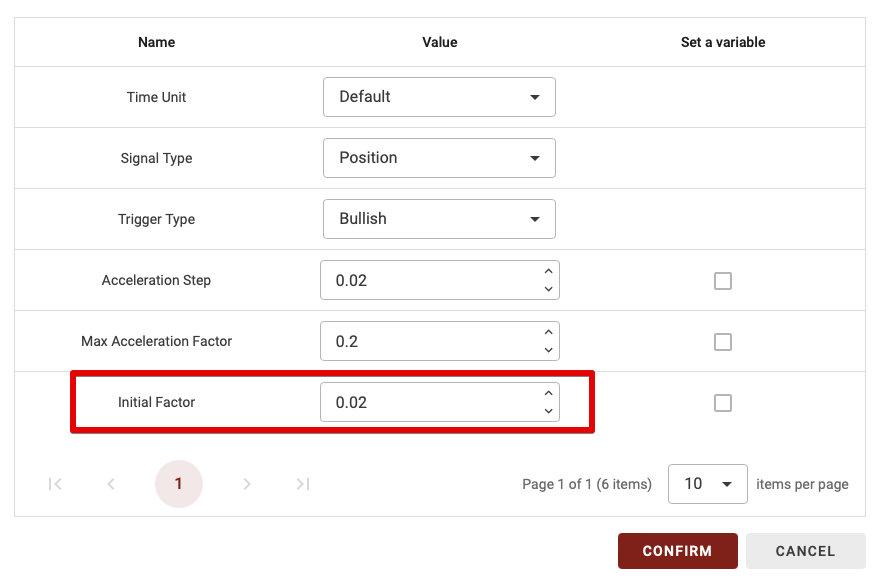

Acceleration Step

The acceleration step determines the sensitivity of the SAR to price movements. The higher the value, the more sensitive the SAR. Thus, the higher the value, the faster the SAR will adjust to the current trend, exposing itself more to the detection of false trend inversions. The default value of this parameter is 0.02.

Max Accelaration Factor

This is the maximum value that acceleration can reach as the trend continues. This parameter limits the impact of acceleration on the SAR value, to prevent it from becoming too sensitive to small price variations. The higher the value, the more reactive the SAR will be at the end of the trend. However, as with the previous parameter, if set too high, it can increase the risk of false reversals. The default value is 0.2.

Initial Factor

This is the indicator’s initial value when a new trend begins. We generally use the same value as the acceleration step.

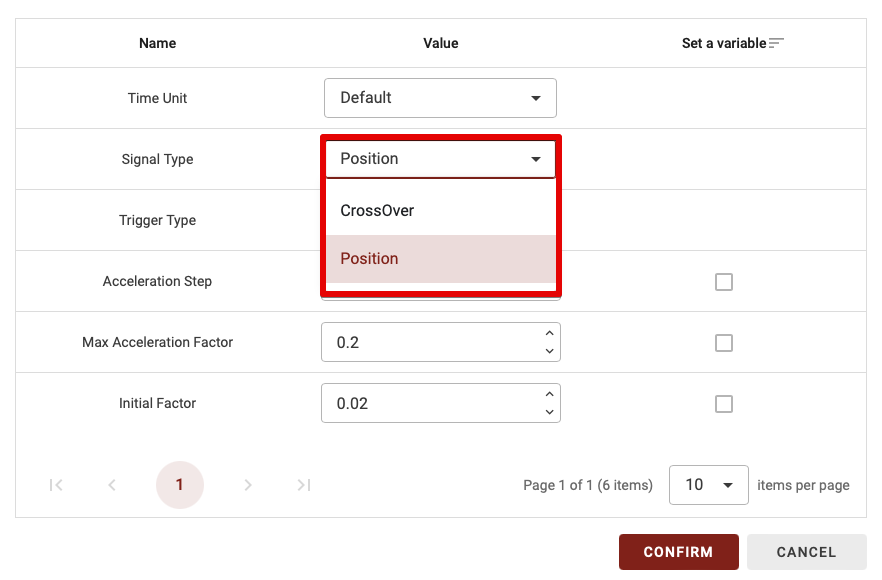

Signal Type

This parameter has only two possibilities: CrossOver and Position. Let’s explain the difference this parameter makes:

- CrossOver: if you choose CrossOver for the signal type, this block will be validated only when the price passes below or above the SAR points.

- Position: with this option, the block will be validated as long as you are in the chosen trigger type (Bearish or Bullish).

TIPS: the CrossOver parameter is much more restrictive, so it’s worth using it when you only have one or two indicators combined. However, if you have too many blocks combined with the Crossover parameter, this will greatly reduce the number of trades in your strategy, as we need, for example, a crossover between the two MAs + a crossover between the RSI 70 threshold + a crossover in the Vortex indicator…

So, when combining several indicator blocks, don’t set more than 1 or 2 blocks with the CrossOvers parameter if you’re a beginner.

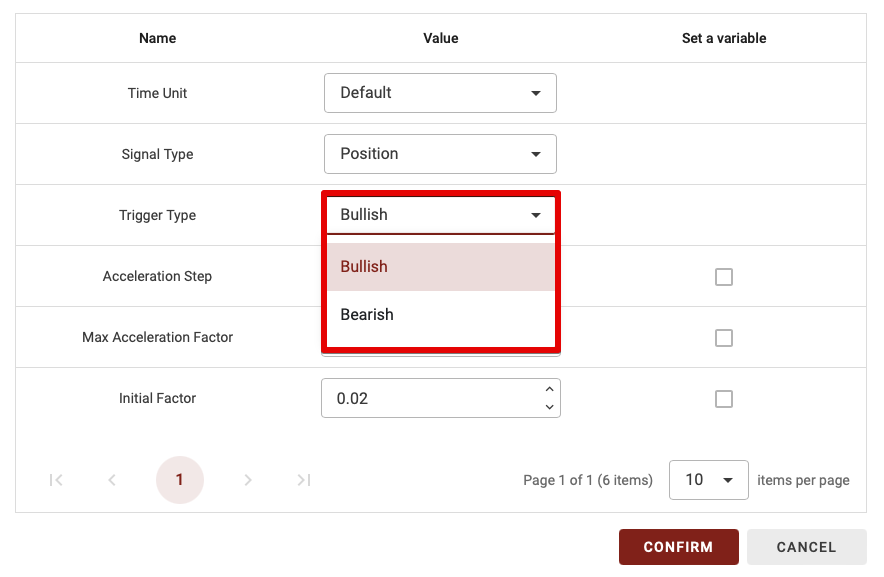

Trigger Type

This parameter has only two possibilities: Bullish or Bearish. Let’s explain the difference:

- Bullish: if you set the trigger type to bullish, the block is validated if the price is above the SAR indicator points.

- Bearish: if you set the trigger type to Bearish, the block is validated if the price is below the SAR indicator points.