Understanding the Marubozu indicator

The Marubozu is the exact opposite of the Doji. It indicates a clear dominant force within a candle: bullish or bearish.

It is defined by a large body and almost non-existent wicks. There are therefore two types of Marubozu: bullish and bearish.

Marubozu block configuration

On BullTrading, you can configure each block to make it unique. In this block, you can define the time unit, the period used, …

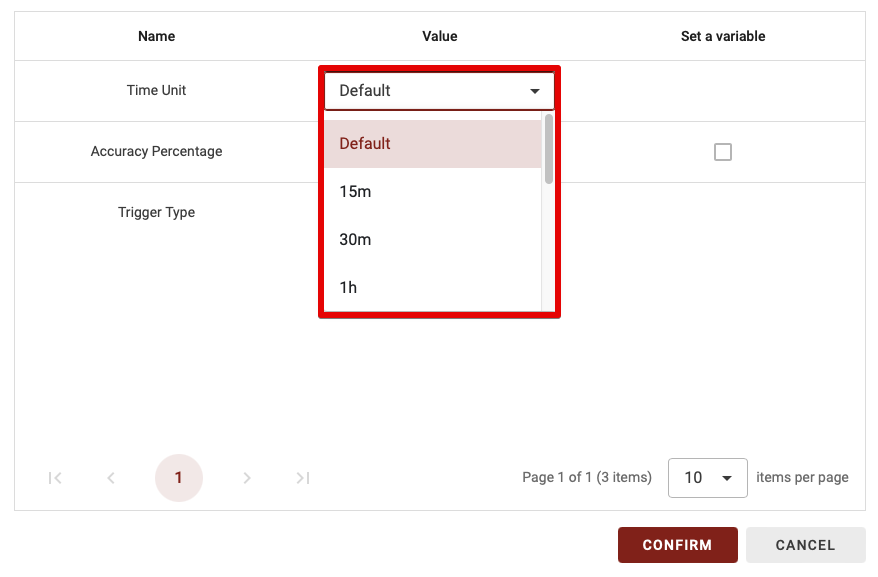

Time Unit

As Bulltrading has the ability to create a multi-timeframe strategy, you have the option of choosing which time period to calculate this indicator on. There are two possibilities:

- Default: if you leave Default, the time unit will vary according to the time horizon you use in the backtest.

- 15m,30m,1d… : If you choose a specific time unit in the time unit, this means that you will choose this specific time unit whatever time unit you use to backtest your strategy.

TIP: If you’re a beginner, I advise you to leave the default time unit.

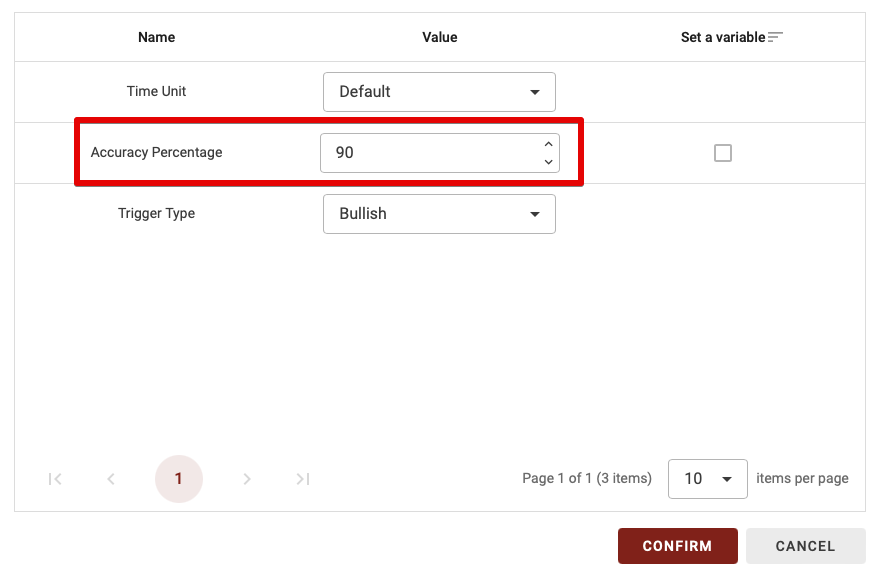

Accuracy Percentage

The “Accuracy Percentage” parameter defines the minimum percentage that the distance between open and close must fill within the distance between low and high. For example, here a candle will be considered a Marubozy only when the variation in absolute value (regardless of sign) is greater than 90%.

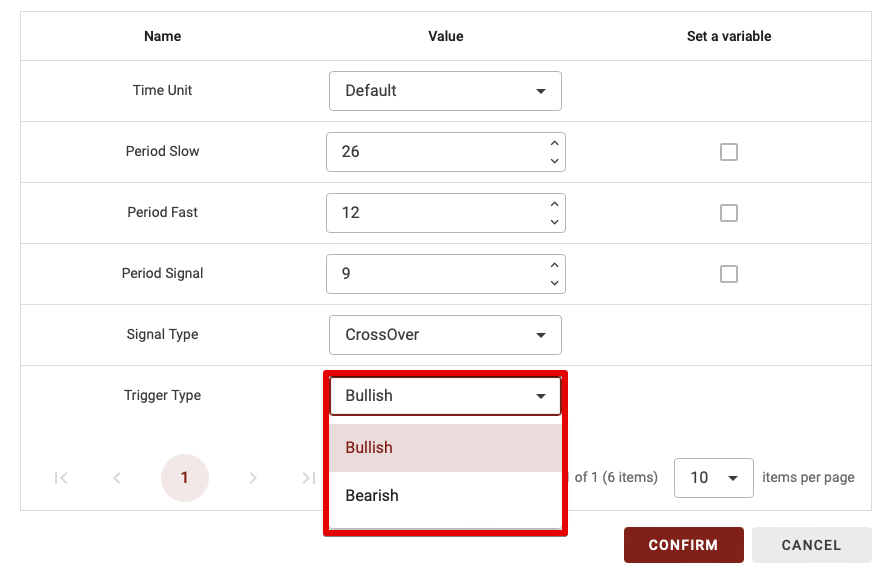

Trigger Type

This parameter has only two possibilities: Bullish or Bearish. Let’s explain the difference:

- Bullish: if you set the trigger type to bullish, the block is validated if the candle is a marubozu with a positive variation from open to close.

- Bearish: if you define the trigger type as Bearish, the block is validated if the candle is a marubozu with a negative variation from open to close.