Understanding the Ichimoku indicator

The ichimoku cloud indicator, also known as the ichimoku Kinko Hyo, is a comprehensive indicator that helps traders identify trends as well as support and resistance levels in the market.

This indicator is one of the most complete and can be used in multiple strategies: trend following, reversal strategy,…

Unfortunately, it’s also one of the indicators with the most parameters to configure.

Ichimoku block configuration

On BullTrading, you can configure each block to make it unique. In this block, you can define the time unit, the period used, …

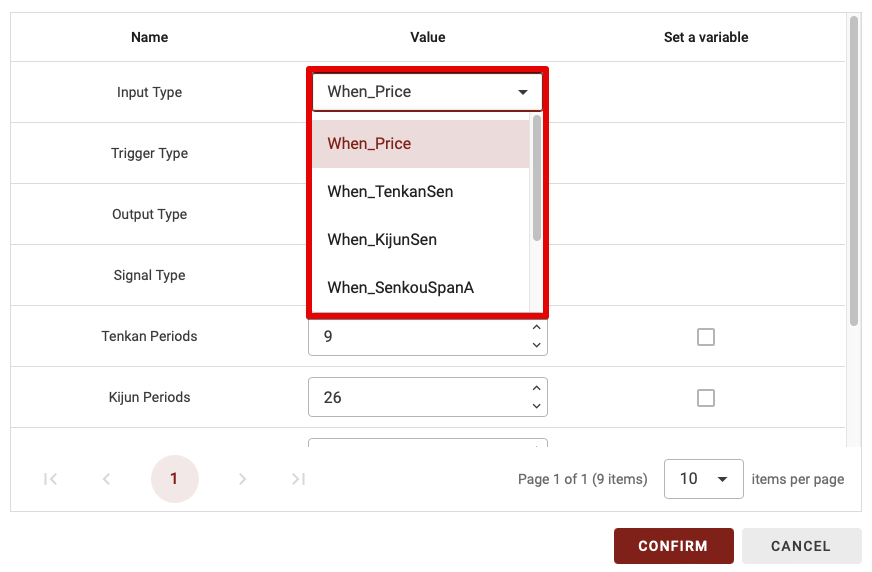

Input Type (first curve)

The condition in this block is constructed somewhat like a sentence. The first parameter is of the form when_ followed by the curve you choose. So, for the first option, it will be when the price… (the condition continues in the next parameters).

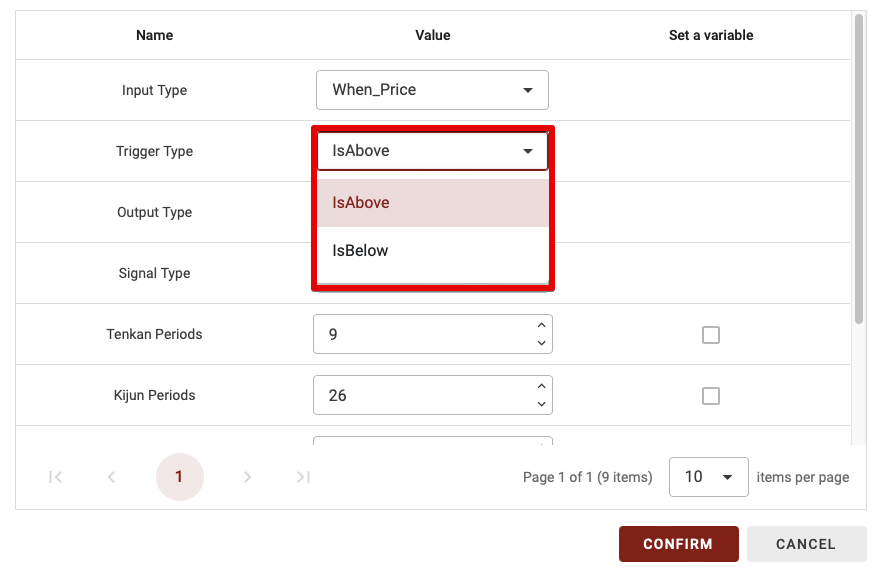

Trigger Type

To create the rest of the condition, we’ll choose whether we want our first curve to be above or below the second to validate our condition. So, if we choose the first option, we get: when the price is above… (the rest of the condition in the next parameter).

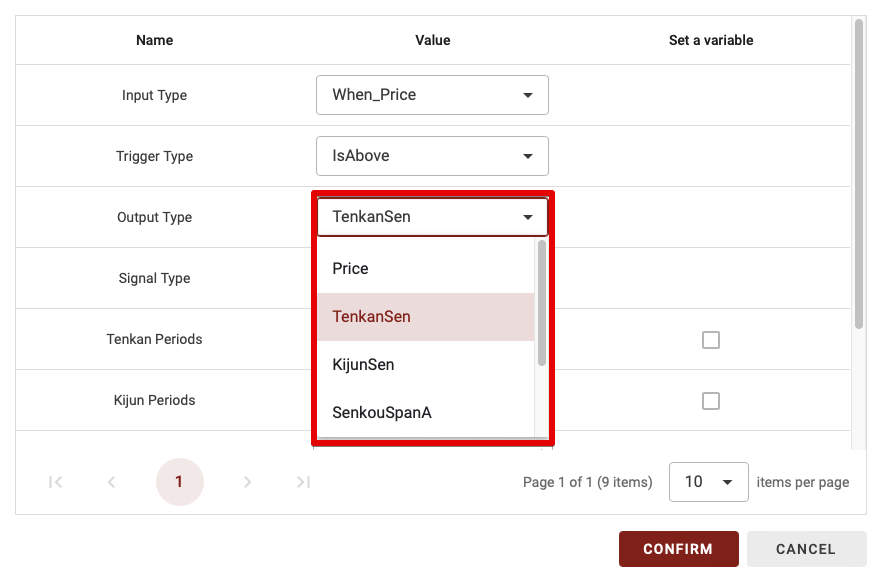

Output Type (second curve)

We continue our condition with the choice of the second curve. If we choose the TenkanSen, for example, if we continue the previous example, we’ll have the following condition: when the price is above (or passes above) the TenkanSen, then the block is validated.

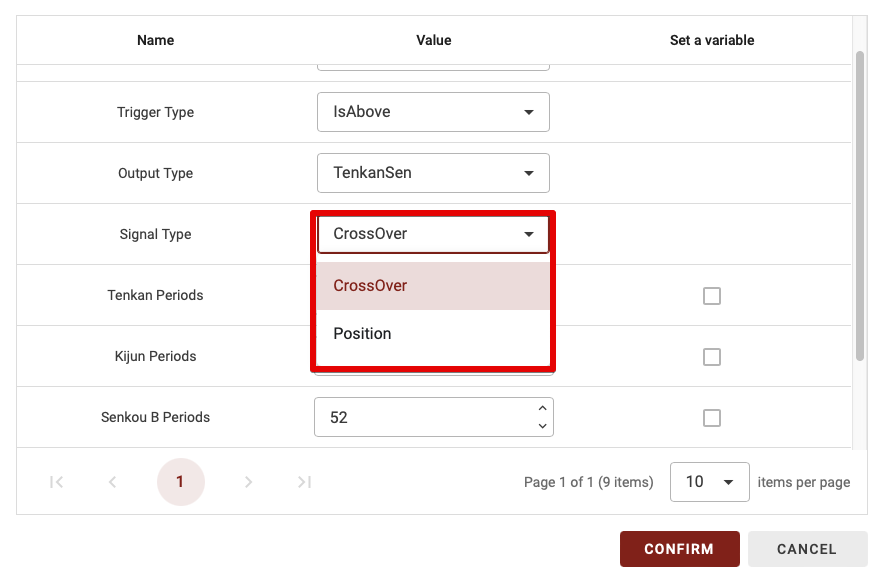

Signal Type

This parameter has only two possibilities: CrossOver and Position. Let’s explain the difference this parameter makes:

- CrossOver: if you choose CrossOver for the signal type, this block will be enabled only when the input type curve passes above or below the output type curve, and only when crossing.

- Position: with this option, the block will be enabled when the input type curve is above or below the output type curve.

TIPS: the CrossOver parameter is much more restrictive, so it’s worth using it when you only have one or two indicators combined. However, if you have too many blocks combined with the Crossover parameter, this will greatly reduce the number of trades in your strategy, as we need, for example, a crossover between the two MAs + a crossover between the RSI 70 threshold + a crossover in the Vortex indicator…

So, when combining several indicator blocks, don’t set more than 1 or 2 blocks with the CrossOvers parameter if you’re a beginner.

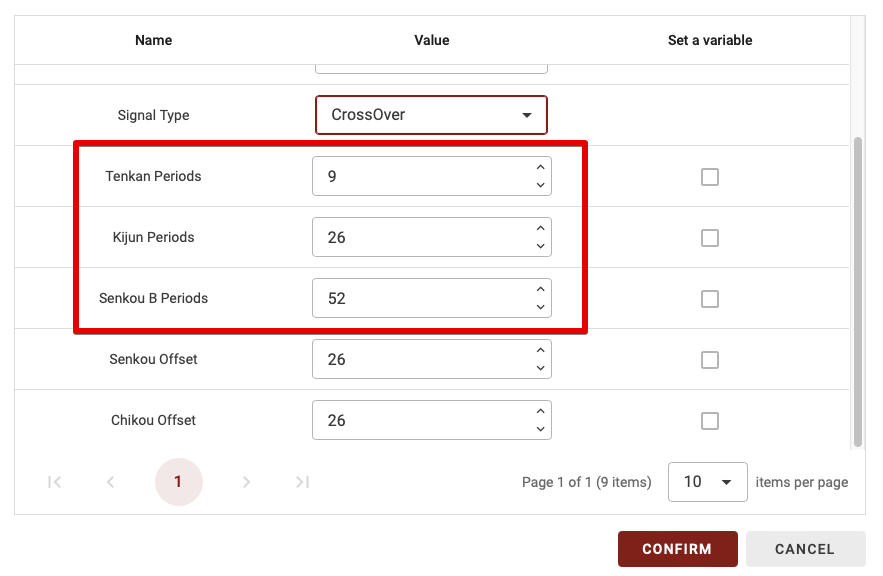

Tenkan, Kijun, Senkou B Periods

As explained in the previous section, the ichimoku is made up of several curves with different periods. It is therefore possible to modify the period of each of these curves.

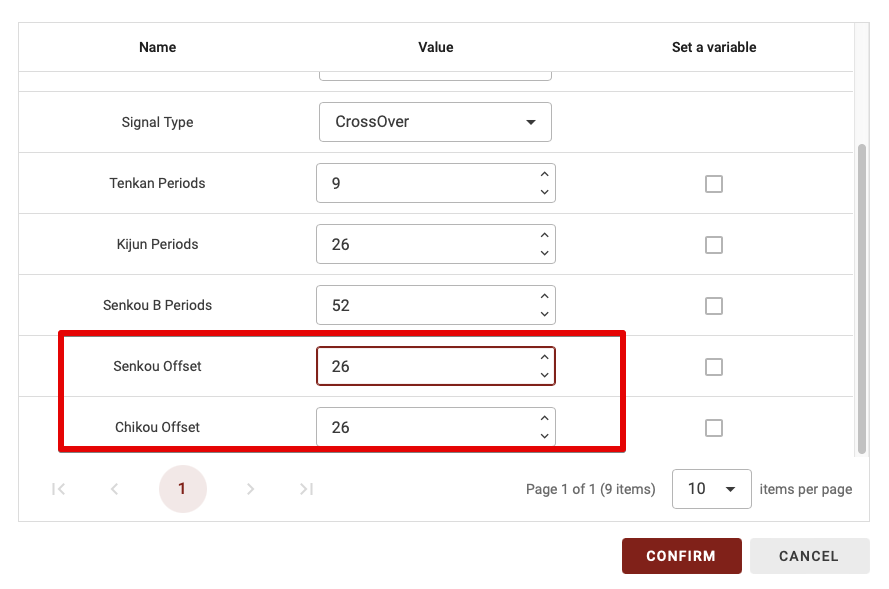

Senkou, Chikou offset

Some ichimoku curves are also shifted by N candles, and this adjustment can be made with the last two parameters.